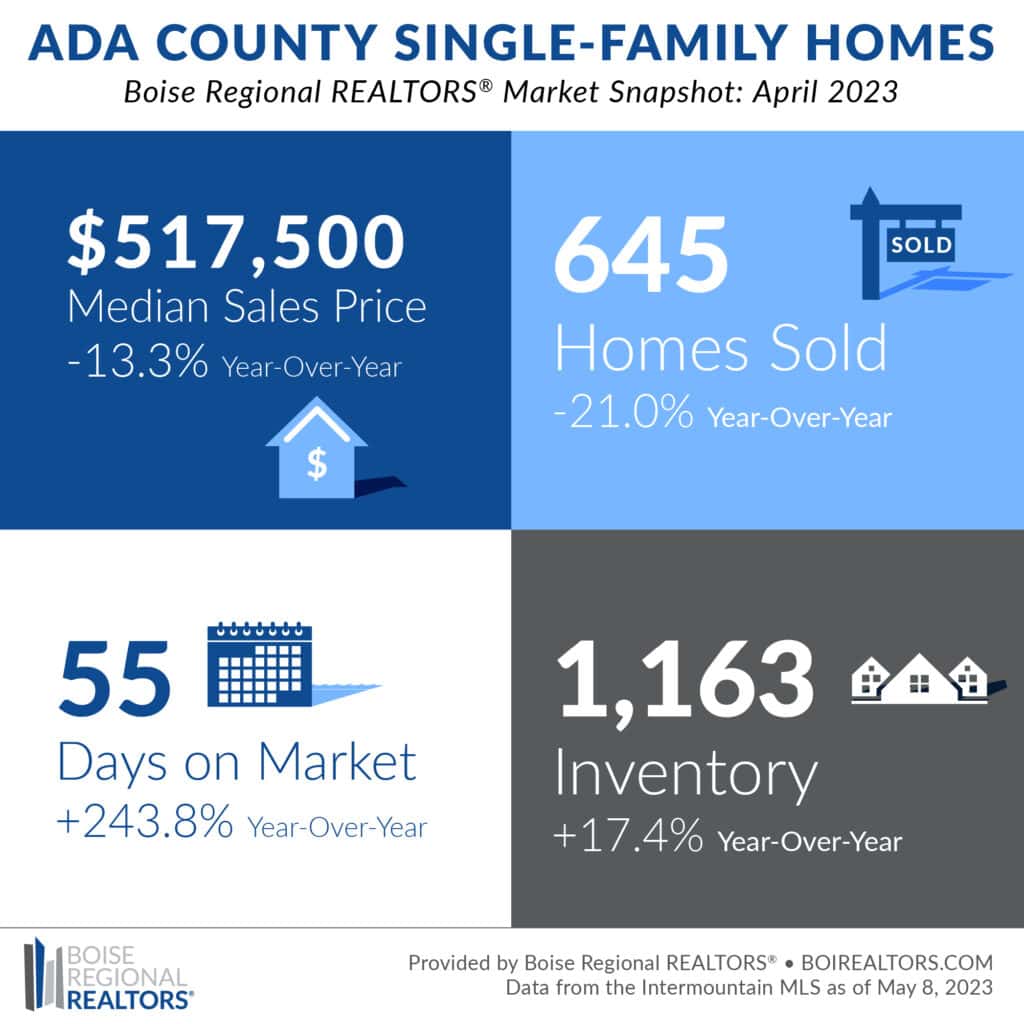

Quick recap:

- Median Sales Price: $517,500 which is down 13.3% year-over-year.

- Homes Sold: 645 which is down 21% year-over-year.

- Days on Market: 55 which is up 243.8% year-over-year.

- Inventory: 1,163 which is up 17.4% year-over-year.

- Click here to learn more.

SALES AND PRICES COOL IN ADA COUNTY

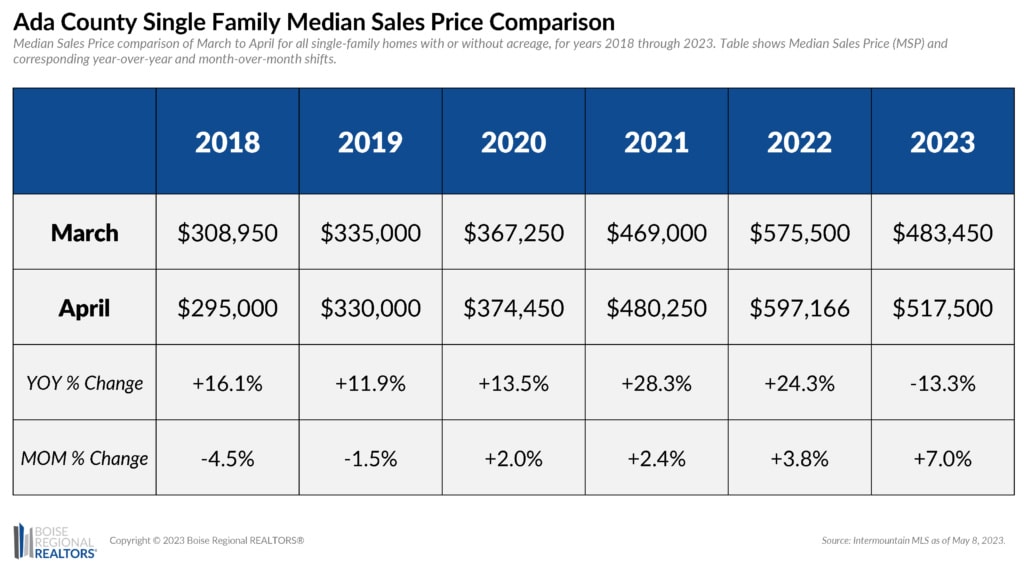

April 2023’s median sales price was $517,500, marking the sixth consecutive year-over-year drop but a $34,000 positive surge from last month. Historically, March to April has shown month-over-month shifts from -4.5% to +3.8%. This month’s 7.0% uptick is uncharacteristically hefty for the season and is the highest month-over-month increase we’ve seen in 19 weeks.

Sales have cooled, as well, giving time for new listings to catch up with demand. There were 645 sales in Ada County, 398 of which were existing homes and 247 were new construction. April marked the fourteenth consecutive year-over-year reduction in sales at 21.0% — 13.1% less than March’s transactions.

Existing homes continue to be the hottest commodity in Ada County, spending an average of 31 days on the market — a surprising 138.5% increase from the same month last year but a 32.6% decrease compared to March of this year. The lurch in existing home sale speed matched the pace of late-summer last year. New construction’s DOM swelled by 287.5% from April 2022, bogging down to 93 days on market — a slight respite from the 106 days we saw last month.

New market landscapes may deter buyers from uprooting due to higher interest rates, but softened prices will ease the blow for those who need to move for life circumstances such as growing families and job relocation. NAR’s Chief Economist Lawrence Yun echoed the uniqueness of the market at this week’s Legislative Meetings in Washington D.C.; the tug-of-war continues between limited supply causing multiple-offer situations — currently 28% of transactions nationwide — and the need for lower prices to account for changes in mortgage rates.

Complications are exasperated by proposed LLPA changes which may affect affordability for some. We will continue to monitor developments on the changes and share them with BRR Members.

Down payment assistance programs and rate buy-down programs continue to be an asset to buyers who are hesitant due to recent mortgage rate changes. Whether consumers are purchasing their first home or upgrading to fit their current lifestyle, real estate remains a powerful long-term tool for their financial portfolio. We encourage consumers to connect with a REALTOR® and learn what programs may fit them best for a changing market — both as a buyer and a seller.

Looking to sell? Call or text Kami at 208.713.1933.

*All information and graphics provided by Boise Regional REALTORS®